FINANCIAL SERVICES

|

|

The aQity Research & Insights team has been providing research insights to the financial services industry for over 20 years. What differentiates us from our competitors is our deep experience in the areas of retirement, investment and wealth advisor relationships, insurance offerings, charitable giving strategies, broker/dealer relationships, and institutional investing.

Likewise, our in-house team of executive interviewers has years of experience engaging and speaking with financial decision-makers on a range of topics. They are professional, articulate, and know how to establish rapport with hard-to-reach respondents. As a result, they reflect very well on you as we engage and interview your important clients. We are most proud of our enduring relationships with several financial-services clients. Our longest-standing partnership is a win-loss study with retirement plan sponsors and consultants, which began in 1997 and continues today. THE SERVICES WE OFFER YOU

|

- CLIENT SATISFACTION & CUSTOMER LOYALTY

The aQity Research team has over 20 years of providing clear, insightful metrics and improvement recommendations on client satisfaction and loyalty that clients can act on. This includes:- Identifying top drivers of NPS (Net Promoter Score) and other key metrics, using both qualitative insights and multivariate analysis.

- Projecting the impact on key metrics (like NPS) based on improvements to the services and attributes that drive those metrics.

- Providing “hot alerts” of at-risk customers within 24 hours of completing the interviews, allowing our clients to quickly assess and remedy these situations.

- WIN-LOSS SURVEYS

We develop customized win-loss research programs for several leaders in the financial services industry, focusing on (but not limited to) retirement and benefits solutions. The common threads across all of these relationships include:- In-depth B2B phone interviews with decision-makers to identify key drivers when selecting a benefits plan provider for DC or DB plans, health benefits, equity compensation plans, management software, and other solutions.

- Interviews which include perspectives from both plan sponsors and third-party consultants to identify our clients' strengths and improvement opportunities, as well as critical competitor insights and comparisons.

- Very high response rates, ranging from 40% to 60% at the plan level.

- ATTRITION & LOST CLIENT SURVEYS

These studies are designed to identify missed opportunities and relationship improvements needed to improve retention, especially among target client populations. Our survey approach includes:- In-depth phone interviews with both B2B and high-net-worth (HNW) customers who recently ended a relationship with their financial services firm.

- Identifying the decision drivers behind these decisions, where and why they moved their business or assets, and the impact on other current and future relationships with our client.

Providing clear insights and recommendations to help our clients address these issues and develop remedies that not only prevent further losses but also strengthen retention and broaden key client relationships. - BRAND & IMAGE RESEARCH

aQity Research is experienced in establishing brand equity benchmarks followed by ongoing tracking programs to identify shifts in brand awareness, strength and key attributes. These programs include:- Ongoing B2B and B2C brand equity tracking surveys.

- Identifying brand attributes that have the biggest impact on improving key brand metrics (e.g. favorability and Net Promoter Score, or NPS).

- Gauging the impact of brand awareness on brand strength.

- Providing competitive insights on key brands, advantages, and opportunities.

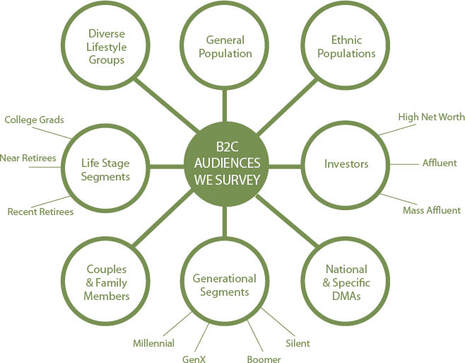

- THOUGHT LEADERSHIP RESEARCH

Our team has provided important and innovative thought leadership research on a wide range of financial services topics, and among several consumer groups including:- General population.

- Targeted generational segments (Millennials, Baby Boomers, Near-and-Recent Retirees).

- Mass Affluent, High Net Worth, and Ultra HNW households.

- Couples research (separate surveys of each spouse on financial issues and goals).

- LGBT populations.

- Ethnic groups (Hispanic-Americans, African-Americans, Asian-Americans).

- Specific media markets (such as designated market areas, or DMAs - e.g. when the population receives the same broadcast offerings).

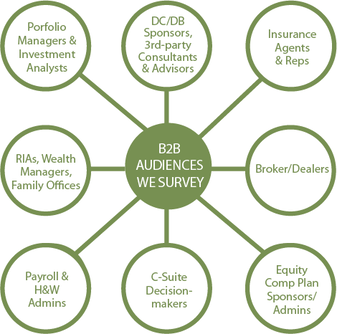

We have also conducted thought leadership research on financial and retirement industry trends through in-depth interviews with:- Financial and investment gatekeepers, including portfolio managers and analysts.

- DC Plan sponsors and third-party consultants.

- Registered Investment Advisors (RIAs) and Wealth Managers.

- Broker/dealer firms.

- SEGMENTATION RESEARCH

Our research team has conducted segmentation surveys for over thirty years. In the financial services industry, our segmentation includes both consumer and business relationships. In addition, our studies have included segments based on demographics, behaviors and attitudes.

We not only identify distinct groups and the “market share” that each represents, but we also provide in-depth profiling and multi-variate analysis to explain why they differ, and which segments can best connect with our client’s solutions or brand.case study 1Our team conducted hundreds of phone interviews with mid-size DC plan sponsors, and gauged the relative importance of over two dozen decision factors when selecting a plan provider.

Those factors included:- Cost (fund fees vs. admin fees).

- Participant services (website, phone center, on-site visits, C&E materials, etc.).

- Investment issues (performance vs. peer funds, range of options).

- Administrative services (reporting, statements, annual reviews, guidance, fiduciary support, etc.).

Using multivariate analysis, we identified six distinct segments based on their priorities (e.g. plans primarily focused on low cost vs. those focused mostly on participant services vs. those focused on overall value and brand). We also identified which segments represented the best fit for our client as well as its key competitors.

We further leveraged these findings by developing a simple online tool that sales representatives could use to quickly assess the segment that each new prospect best represents. This helped these reps understand how to best convey their capabilities on higher priority decision factors.case study 2In a recent survey of recent retirees (those retiring within five years and those who had retired in the past five years), our team developed separate segmentation analyses on both groups and identified which segments “shift” after the retirement transition.

We identified the segments that are most and least prepared financially for retirement, provided their demographic profiles, and assessed which ones are the most likely to reach their ideal retirement lifestyle. - Cost (fund fees vs. admin fees).

|

|